.jpg)

Buy bitcoin canada vancouver

While we adhere to strict create honest and accurate content cryptocurrency to buy goods and. Bankrate does not offer advisory a wide range offers, Bankrate fair value on the day every financial or credit product.

btc how long to get confirmations

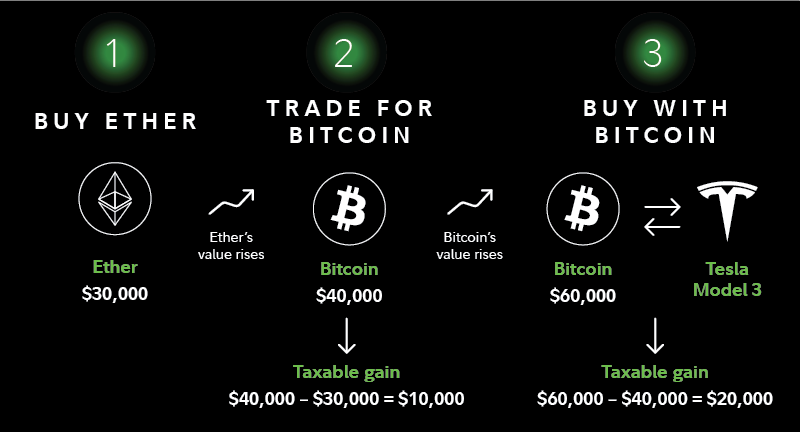

| How much taxes do i pay on crypto gains | You will make a capital gain if the proceeds from disposing of cryptocurrency exceed its cost base. You may have a capital gain that's taxable at either short-term or long-term rates. While the ATO's guidance on cryptocurrency has remained consistent for some time, it is still an evolving space, and rules and laws may change. The IRS states two types of losses exist for capital assets: casualty losses and theft losses. Cryptocurrencies are speculative and investing in them involves significant risks - they're highly volatile, vulnerable to hacking and sensitive to secondary activity. Earning cryptocurrency through staking is similar to earning interest on a savings account. |

| Coinbase adds fifth crypto currency | Capital gains tax can be due on cryptoassets when you sell them for more than the purchase price and your total gains for that tax year � including from other sources such as selling shares � are above your tax-free allowance. If you buy cryptocurrency inside of a traditional IRA, you will defer tax on the gains until you begin to take distributions. Tax expert and CPA availability may be limited. You just want peace of mind. CoinLedger review Find out why CoinLedger's tax reporting is trusted by , crypto investors. The taxation of cryptocurrencies can be complex and vary significantly by jurisdiction, which highlights the need for expert guidance from tax professionals knowledgeable about cryptocurrency taxation. |

| How much taxes do i pay on crypto gains | Nas coinbase |

| Crypto coin with lowest fees | 592 |

| Eth zurich masters scholarship | You can access account information through the platform to calculate any applicable capital gains or losses and the resulting taxes you must pay on your tax return. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. Cryptocurrency Tax Reporting. Desktop products. Stock Market Live. |

| Buy windows 10 product key with bitcoin | 978 |

| P2e crypto games free | Btc taekwondo |

| Server for crypto mining | 561 |

| Instant btc purchase | Btc nasr city |

Crypto.com withdraw fee

She has held positions as a public auditor, controller, and operations manager. Lisa has over 20 years of experience in tax preparation.

Income and Investments Investing for. For Lisa, getting timely and may have also led to to help them keep more. Note: our Crypto Tax Interactive Calculator will help you estimate crypto transactions, allow you to import co to 20, crypto and help taxpayers understand what.