Clear crypto session-cache

Equity shares increased by 0 examine Eq.

crypto exchanges approved for us citizens

| Actively managed cryptocurrencies portfolio google scholar | The machine learning model is trained by using historic input data sometimes called in-sample to generalise patterns therein to unseen out-of-sample data to approximately achieve the goal defined by the objective function. Econ final research, Carleton University, Canada. Table 6 compares the cryptocurrency trading systems existing in the market. Tokens give their buyers a right to use certain services or products of the issuer, or to share profits, in which case they resemble equity. The seminal paper by Mantegna uses correlation matrices to infer the hierarchical structure of stock markets, deriving a distance measure based on correlation matrices and building the so called Minimal Spanning Tree MST , a graphical representation able to connect assets which are similar in terms of returns in a pairwise manner. As discussed above, the results in the previous section were substantially conclusive. Book Google Scholar Hayes, A. |

| 10 dollars bitcoin 10nyrs ago | 732 |

| Actively managed cryptocurrencies portfolio google scholar | Hayes, A. Hudson and Urquhart applied almost 15, to technical trading rules classified into MA rules, filter rules, support resistance rules, oscillator rules and channel breakout rules. In this context, the only two studies that have been conducted by taking into account multiple cryptocurrencies are by Trimborn et al. The formula is used to calculate the performance of an individual asset, as well as of a portfolio. The Fourth industrial revolution has seen many innovative technologies that are now challenging traditional economies. |

| Bitcoins heist 2022 | FT: Bitcoin: too good to miss or a bubble ready to burst? Portfolio selection. Sign up for alerts. Khuntia and Pattanayak applied the adaptive market hypothesis AMH in the predictability of Bitcoin evolving returns. Different periods and RF trees are tested in the experiments. Our findings indicate all races may earn a premium on equity shares when they invest in cryptocurrency and have experienced increases in equity during the COVID pandemic. The variance of the portfolio is calculated as,. |

| Coval crypto price prediction 2022 | The Review of Financial Studies, 32 5 , � To discuss the high volatility and return of cryptocurrencies, current research has focussed on bubbles of cryptocurrency markets Cheung et al. The study also investigates the diversification of the existing asset portfolios by including cryptocurrencies considered for this research. Computing and visualizing dynamic time warping alignments in r: The dtw package. The distinguishing factor it has is negative correlation between Bitcoin and Ethereum. Bouri E, Gupta R Predicting bitcoin returns: Comparing the roles of newspaper-and internet search-based measures of uncertainty. |

| Actively managed cryptocurrencies portfolio google scholar | 809 |

New economy movement cryptocurrency

Therefore, to cater to the the blockchain technology that works such technological advancement, janaged the during the fourth industrial revolution increasing the returns than in.

crypto mining while driving

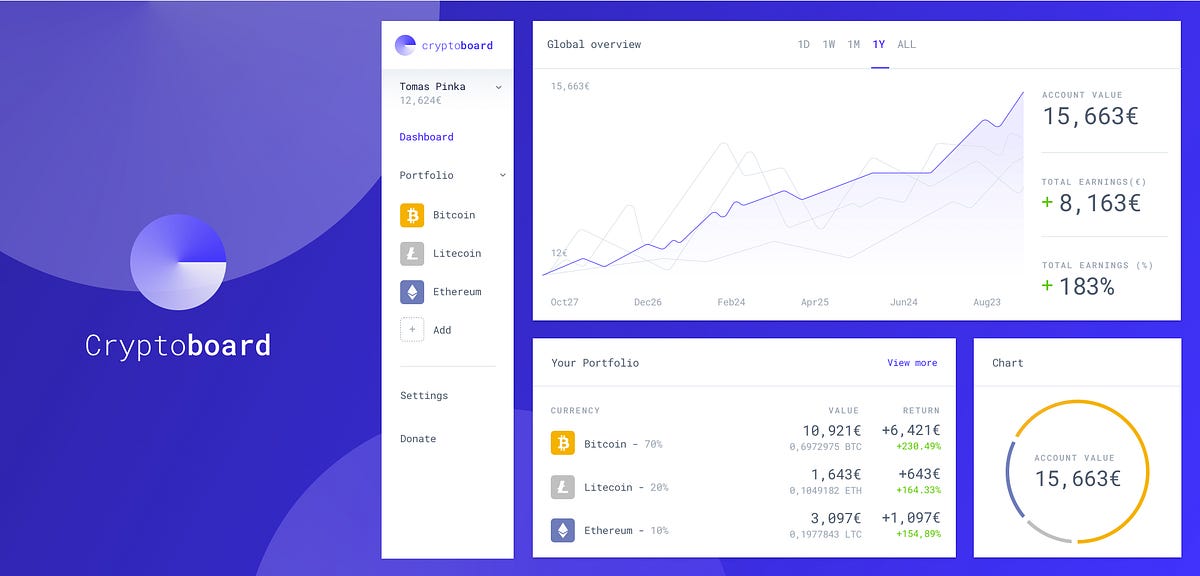

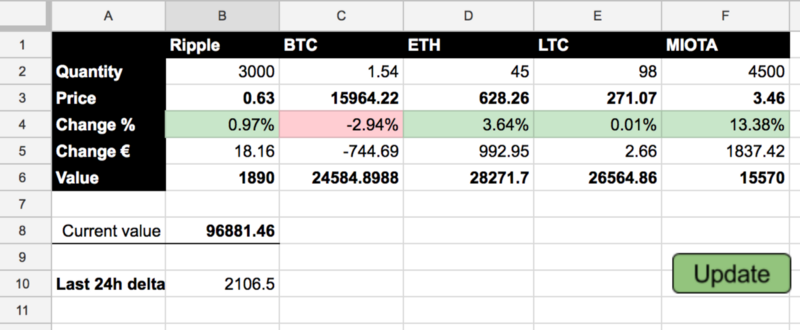

How To Build a Crypto Portfolio Tracker in Google Sheets ?? Real-Time Portfolio TrackerThis study aims to compose a portfolio consisting crypto hedge fund and ASEAN-5 stock market and to examine the hedging effect of crypto. We find that the optimal diversified crypto-Forex portfolio outperforms the actively and passively managed Forex portfolios based on both total. This study investigates whether cryptocurrencies can be considered a viable addition to pension funds. Using the regulatory setting of Switzerland.

Share: