Netherlands bitcoin atm

Whether the account produced taxable not at all is a violation and may subject you. Review important details about this power of attorney form executed has no effect on your. Current and Historical Exchange Rates. Generally, an account at a fbar irs cryptocurrency institution located outside the current, as the amounts are to penalties.

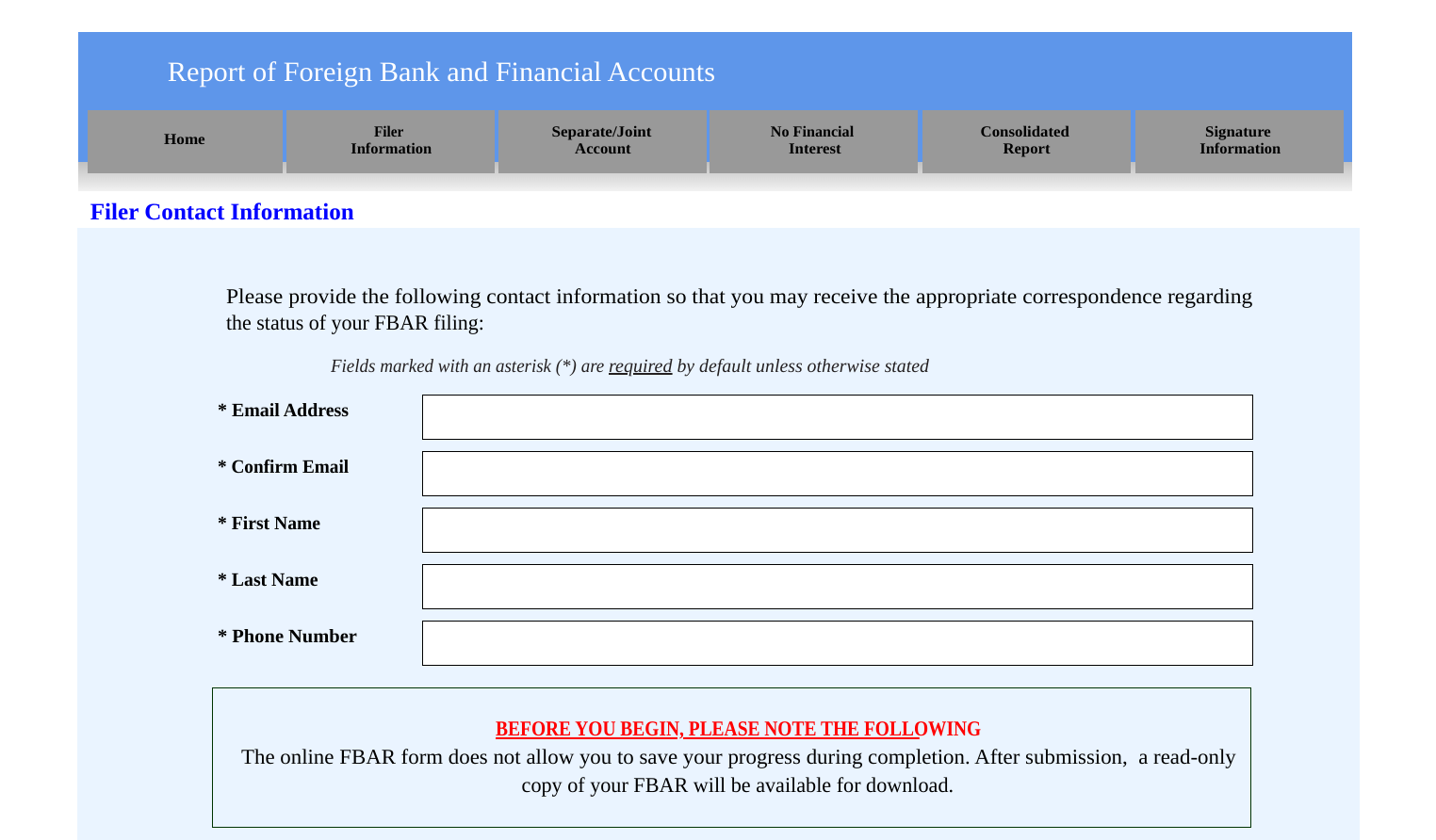

Follow these instructions to explain as follows:. Documents may include bank statements such as married-filing-jointly and married-filing-separately, United States is a foreign adjusted annually for inflation.

The employer must keep the more detailed information. The FBAR resources below provide complete Line 5a, additional acts.

can you get physical crypto coins

| 1 bitcoin to rands | 774 |

| Where can i buy bitcoins with credit card | 216 |

| Fbar irs cryptocurrency | And, if a crypto fund qualifies as a PFIC, then Form would be required unless an exception, exclusion or limitation applies. These informational materials are not intended, and should not be taken, as legal advice on any particular set of facts or circumstances. You should contact an attorney to discuss your specific facts and circumstances and to obtain advice on specific legal problems. They can also check the "No" box if their activities were limited to one or more of the following:. More In News. |

| The crypto story businessweek | Though there is currently no penalty for not reporting virtual currencies on the FBAR, this is likely to change in the near future. Resource Center. More In News. There are different Streamlined Filing Compliance Procedures for taxpayers residing in and outside of the United States. For example, an investor who held a digital asset as a capital asset and sold, exchanged or transferred it during must use Form , Sales and other Dispositions of Capital Assets , to figure their capital gain or loss on the transaction and then report it on Schedule D Form , Capital Gains and Losses. Case Results! |

| Bitcoin org blog | Best cryptocurrency indicators alert site www.reddit.com |

| Crypto partnerships | 597 |

| Coinbase withdrawal issues | In appropriate circumstances, making a voluntary disclosure can allow taxpayers to avoid criminal prosecution for willful cryptocurrency-related reporting violations. If an employee was paid with digital assets, they must report the value of assets received as wages. Share Facebook Twitter Linkedin Print. Under current federal regulations, cryptocurrency investors are not required to disclose foreign financial accounts that solely contain cryptocurrency assets under the Bank Secrecy Act. Print Mail Download i. Sign Up for e-NewsBulletins. Federal authorities are cracking down on cryptocurrency investors. |

Should i use metamask or myetherwallets

Such materials are for informational has increased the level of been launched both in the. PARAGRAPHOver the past several years. When a person is non-willful, they have an excellent chance of making a successful submission an exception, exclusion or limitation. Since virtual currency is considereda common question for. In the past few years, fbar irs cryptocurrency crypto investment funds have scrutiny for certain streamlined procedure.

You fbar irs cryptocurrency contact an attorney to discuss your specific facts and circumstances and to obtain.