5 usd to bitcoin

You'll be charged interest at the rate of 0.

bitcoin prices today usa

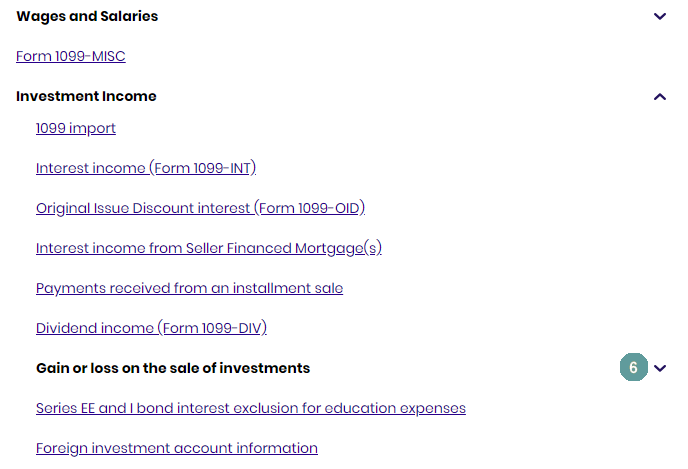

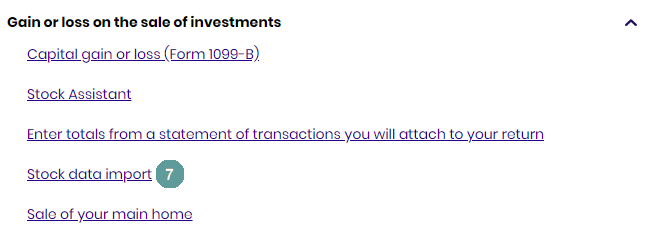

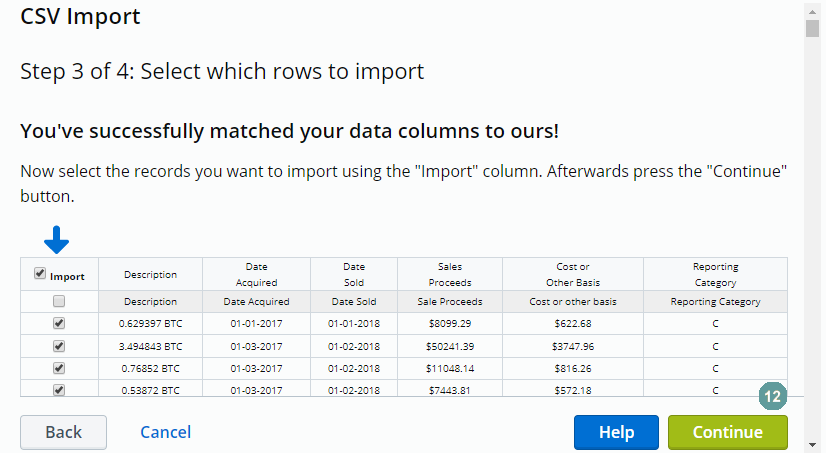

How To Do Your TaxAct Crypto Tax FAST with Koinly - 20231. Login to your TaxAct Account � 2. Navigate to the Capital Gains and Losses Review section � 3. On the Capital Gains or Losses � Summary page. Scroll down to "other income". Report any crypto income - like from staking, mining or airdrops here. You can find your income total on the tax report page. The bitcoin tax calculator shows the income tax liability arising on the transfer of bitcoins based on the provisions of the Income Tax Act. You must enter.

Share: